What is Cost Basis?

Investopedia defines cost basis as:

The original value of an asset for tax purposes (usually the purchase price), adjusted for stock splits, dividends and return of capital distributions. This value is used to determine the capital gain, which is equal to the difference between the asset’s cost basis and the current market value. Also known as “tax basis”.

Why is it important?

The IRS is requiring more and more reporting of your cost basis of your investment. They also require your report the capital gains/losses of your investments. To calculate your capital gains you need to know your cost basis.

How do you calculate it?

On the surface calculating cost basis sounds easy. Just use the price you paid for your stock. For example, if you purchased a 100 shares of XYZ company for $120 then your cost basis is $120. However, things get complicated if you had 3 for 2 stock split. Also, what if you purchase an additional 50 shares for $90? What if you have a split, reinvest capital gains and purchases in a given year? What is your cost basis? Now things get really complicated.

How EquityStat makes things easier

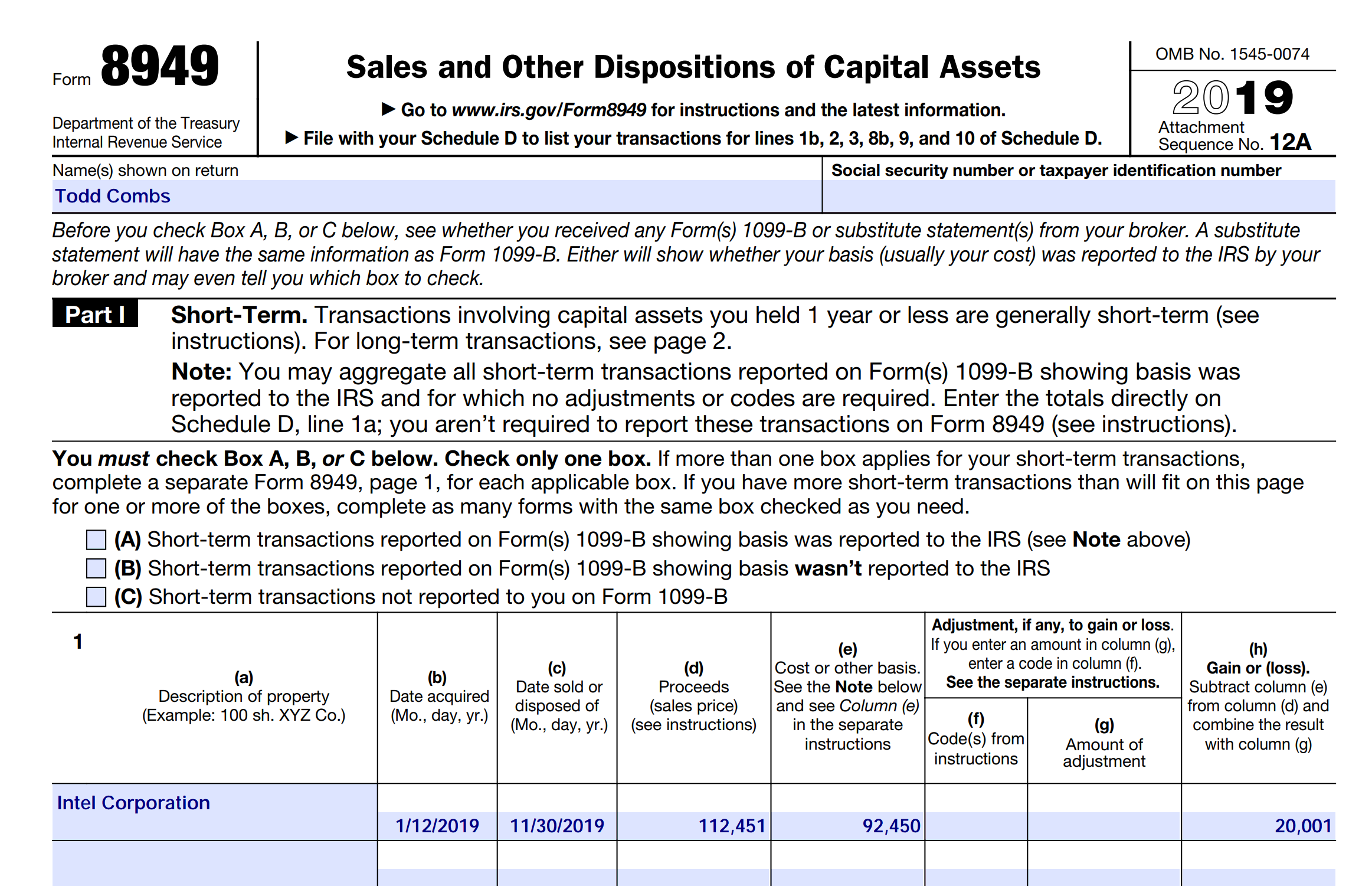

With EquityStat all you have to do is enter your purchases, splits, capital gains and we will calculate your cost basis. Then when you sell your stock whether all of your shares or just some of your shares, we can easily calculate your gain or loss. You can then generate IRS Form 8949 that will show your cost for each investment you sold in the last year.