Did you sell any of your investments in 2024? If so, determining how much tax you owe on these sales requires calculating both short-term and long-term gains or losses.

EquityStat simplifies this process by allowing you to generate IRS Form 8949, which calculates these values for you. Follow these steps to create the form:

- Open the Tools menu and select Generate Form 8949.

- On the Generate Form 8949 page, click the Generate button.

Your short-term and long-term gains/losses on any investment sales will then be calculated, and a pdf format of IRS Form 8949 will be generated. This form has a short-term gains/losses section and long-term gains/losses section, which is what you need when filing your taxes.

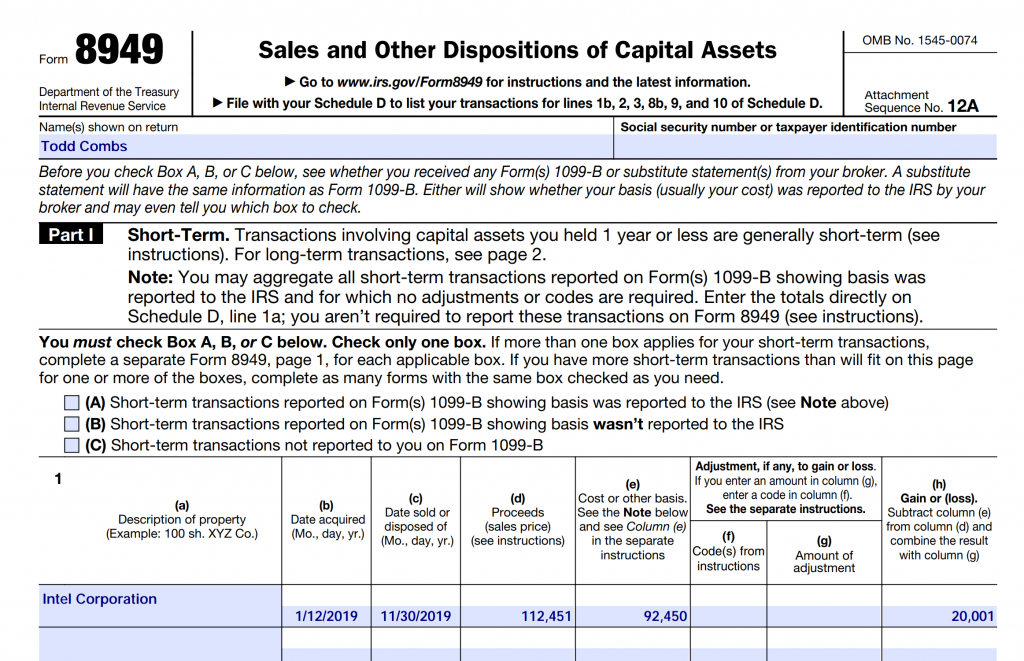

Here is an example of Form 8949.

Once this pdf form is generated, you can then email this pdf file to your tax preparer or print a copy of it. With this IRS form, your tax preparer can then calculate your taxes on your investment sales.